Courtesy of author Dr. Bobby Hoffman: Motivation for Learning and Performance. Courtesy of author Dr. Bobby Hoffman: Motivation for Learning and Performance.

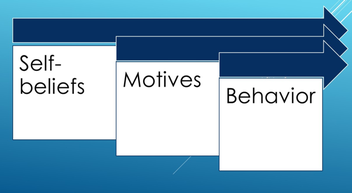

Self-beliefs. Each of us hold a number of different beliefs about the world in which we live. Some are minor beliefs, but others can have a profound influence on success. For instance, to what degree do you believe in destiny, fate, or luck? People that hold a strong belief that control is external will have less personal success than people that believe they are in charge of their own destiny. Beliefs influence our motivation which then shapes our behaviors. One reason behavioral analysis has struggled is the difficulty in tracing an observed behavior to a single root cause. Two people may commit a similar crime (theft), but hold radically different self-beliefs that led to different motivations for the commission of the theft. As the number one enemy of success, there is some good and bad news. The good news is that self-beliefs are adaptive, your beliefs can evolve over time. The bad news is self-beliefs are stubborn and modifying one's beliefs is not a clearly defined linear process. The stubborn nature of our beliefs results in behaviors that are highly adaptive in one environment, but maladaptive in another. Consider a child raised in a large family, developing a strong collectivist belief verses a belief in individualism. As the child leaves the family environment to enter the workforce he or she will most likely find it more difficult to find success in certain industries where a collectivist belief is often maladaptive, e.g. a stock trader or car sales. The bottom line, the beliefs we hold are a powerful key that can drive or inhibit success. The main challenge is that we most often do not even realize how our beliefs and environment interact to influence our motivations and corresponding behaviors. If you want to know how you can combat this enemy there are various techniques that revolve around the larger concept of "self-regulation". It is through self-regulation that both the symptoms and causes of maladaptive behaviors can be addressed. I have included a link to a 1991 article published by Dr. Albert Bandura, arguably the leading expert on self-regulation, and a link to Dr. Hoffman's work which is more current, published in 2015.

Note: This article was initially a response to the question, "What is the Biggest Enemy of Success?" on Quora.com.

0 Comments

Okay, okay, I know my title is a really bad Meghan Trainor reference, but when it comes to making better decisions, using base rates can help you stay out of trouble. From what you pay for insurance to deciding whether or not to start a business, base rates are key to reducing your risks and maximizing results. That said, there is plenty of scientific evidence from psychological studies that demonstrates people tend to ignore base rates. This tendency is a well-established cognitive bias known as "base rate neglect" or the "base rate fallacy". In this article I explain base rate neglect, why base rates are ignored and how you can harness this bias to help you make better decisions.

Explaining base rate neglect. For a real life example, take the $50 opportunity currently offered by insurance giant AIG to provide you “FlightGuard” coverage that guarantees a $500,000 payout to your beneficiary in the event your flight crashes and you die. This means every 10,000 flights without loss of life AIG will make a profit. Now using the base rate we can calculate the extent to which $50 for $500k in coverage is a fair offer. The actual odds that you will die in a plane crash are approximately 1 in 11 million. Based on this base rate, over time AIG is making slightly more than 1,000 times the money they will pay out. Indisputably this is a horrific deal for the consumer. In fact, it is such a bad deal that you would be much better off taking that same $50 and buying fifty lottery tickets in the “Texas Lotto”. The minimum you can win in the lotto is $4 million, 8x the insurance payout. And your odds of winning with 50 tickets are roughly 1 in 500,000 or 22x higher than the odds of dying in a plane crash. Now I’m not saying playing the lottery is a great deal either, but using the base rate I can definitely tell you it is a deal approximately 175x better than buying “FlightGuard” insurance from AIG. Why then do people ignore base rates? This question has been of great interest to psychologists for quite some time and there are a number of theories that revolve around different forms of cognitive bias. Reduced to practical reasons, people ignore base rates due to:

Using base rates to your benefit. Given base rates are often ignored, the same as insurance companies or casinos, you too can profit. You can use base rates to make better decisions, but using a different strategy. Almost every company across a diverse range of industries such as medical, insurance, entertainment and technology use base rates to target millions of consumers who make small, seemingly insignificant decisions. These individual decisions collectively add up to billions in profits, a “nickel and dime” strategy. Your strategy to profit from base rates must be different, basically the opposite of the “nickel and dime” strategy. Instead of targeting relatively insignificant decisions, you will benefit by looking at those major, tough decisions in life where making a mistake may have significant consequences. You need to factor in base rates when making a major purchase like buying a house or car, when deciding to open a business or pursue a specific degree, or more importantly when determining if a risky medical procedure is your best option. Using a risky medical procedure, say heart surgery, let's go through a quick example. Thanks to the Internet there is now a wealth of base rate information only a few clicks away. You can find out what are the base rate odds of surviving the heart procedure, but don’t stop there. You can then begin to adjust from this base by factoring in the base rate performance of specific hospitals and/or specific doctors. In addition, you can find out base rates of post surgery rehabilitation and life expectancies. Using this base rate information can help you make a more informed decision, give you a better chance of surviving the procedure and know what to expect after the procedure is over. In summary, one way to avoid trouble and make better decisions is recognizing that it's all about that base rate. When faced with a tough decision, taking into account the possibility of base rate neglect can improve your chances of success. And if you don’t happen to know Meghan Trainor or the song, then click here to see my shameful attempt at humor.

About the Author:

Richard Feenstra is an educational psychologist who adamantly denies the existence of a video of him singing "All About That Base". |

Authors

Richard Feenstra is an educational psychologist, with a focus on judgment and decision making.

(read more)

Bobby Hoffman is the author of "Hack Your Motivation" and a professor of educational psychology at the University of Central Florida.

(read more) Archives

April 2023

Categories |

RSS Feed

RSS Feed